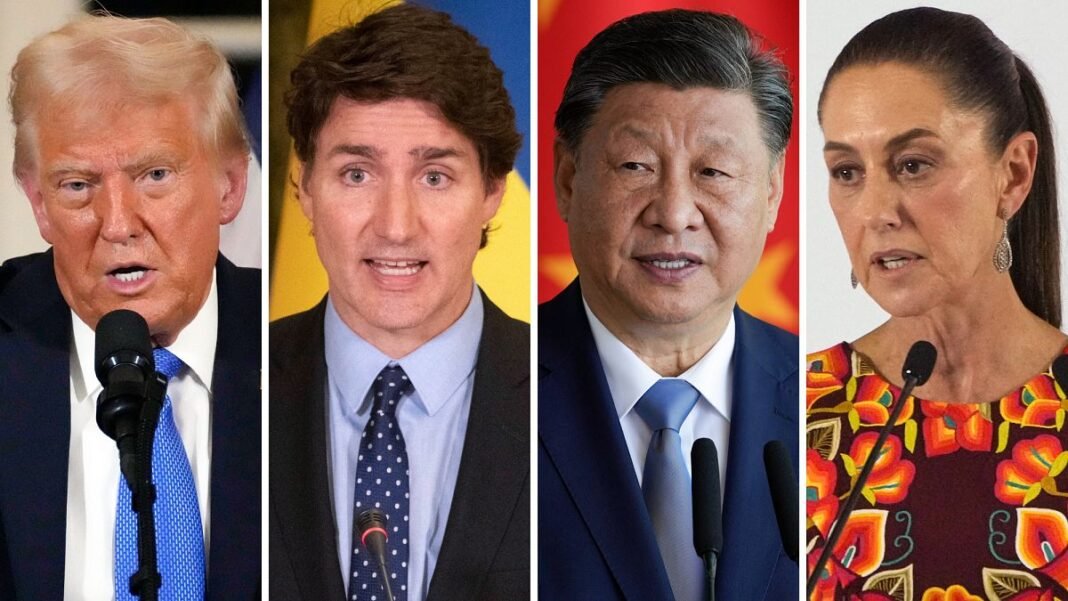

US President Donald Trump stated he would proceed with deliberate tariffs on Canada, Mexico, and China, inflicting a broad selloff in US inventory markets.

International inventory markets slumped following Trump’s announcement that he would proceed with 25% tariffs on Canada and Mexico, alongside extra 10% levies on Chinese language imports.

Each Canada and China responded with retaliatory measures, rising fears of an escalating international commerce conflict.

Responses from Canada and China

Canadian Prime Minister Justin Trudeau introduced that Canada will impose 25% tariffs on C$155 billion (€102.1 billion) value of US items, with tariffs on C$30 billion (€19.8 billion) of imports coming into impact on Tuesday and the rest in 21 days.

“Our tariffs will stay in place till the US commerce motion is withdrawn, and will US tariffs not stop, we’re in lively and ongoing discussions with provinces and territories to pursue a number of non-tariff measures,” Trudeau stated in an announcement.

China, in the meantime, signalled that it could impose extra tariffs of as much as 15% on imports of key US farm merchandise, together with rooster, pork, soy and beef, and would additional prohibit enterprise with US firms.

China’s Ministry of Commerce had launched an earlier assertion saying that Beijing was “strongly dissatisfied” with US tariffs and would “take countermeasures to safeguard its rights and pursuits”.

In February, China already imposed a 15% levy on coal and liquified pure fuel (LNG) from the US and a ten% obligation on American crude oil, farm tools, and sure automobiles, following the Trump Administration’s preliminary 10% obligation on China’s imports.

Final month, Trump additionally signed a memorandum directing the Committee on Overseas Funding to curb Chinese language funding within the US.

European markets surge

Danger-aversion sentiment dominated international market traits, sending US inventory markets sharply decrease.

The tech-heavy index Nasdaq slumped 2.6%, erasing all of the positive aspects since Trump’s victory within the election.

The US greenback weakened towards most different main currencies as a consequence of a stoop within the US authorities bond yields.

Nevertheless, the Canadian greenback and the Mexican Peso declined sharply towards the buck.

US authorities bonds, or Treasuries, are thought of safe-haven property and bond costs transfer inversely with bond yields. Different haven property, together with gold and the Japanese Yen, have all skilled sturdy positive aspects.

In distinction to declines in US inventory markets, European equities continued their record-breaking rally, with each the Euro Stoxx 600 index and Germany’s DAX hitting new highs on Monday.

Defence shares soared, boosting the economic sector within the bloc. Shares in Rheinmetall AG surged 13.7%, Airbus rose 5.9%, and BYYER AG climbed 5.7% after UK Prime Minister Keir Starmer met Ukrainian President Volodymyr Zelenskyy in London.

Starmer pledged to work with Ukraine on a method to finish the conflict, rising the probability of upper navy spending in Europe.

European indexes such because the Stoxx 600, the DAX, and the CAC 40 nonetheless confirmed marginal declines on Tuesday morning.

Rise for the euro and bond yields

The euro, in the meantime, strengthened in the beginning of the week as most European authorities bond yields rose following hotter-than-expected February inflation information, complicating the European Central Financial institution’s (ECB) outlook on aggressive price cuts.

On Monday, Germany’s 10-year Bund yield climbed 10 foundation factors, contrasting with a 9 bps drop within the 10-year US Treasuries. EUR/USD surged by practically 1 cent, surpassing 1.0480.

Bitcoin retreated to simply underneath $84,000 (€80,100) at 07:20 CET on Tuesday from Monday’s excessive above $94,000 (€89,600), mirroring the broad sell-off in expertise shares.

The world’s largest digital token skilled a short-lived surge after Trump posted on Fact Social that he would “transfer ahead on a Crypto Strategic Reserve” and “make certain the US is the Crypto Capital of the World”.