Wall Avenue witnessed a brutal selloff on Friday, March 28, as renewed fears of inflation, collapsing shopper confidence, and skepticism about synthetic intelligence (AI) investments got here up in opposition to continued uncertainty over President Donald Trump’s daring tariff insurance policies.

The S&P 500 dropped 2 per cent, marking its second-worst day of the yr, whereas the tech-abundant Nasdaq fell 2.7 per cent. The Dow Jones Industrial Common misplaced 715 factors, a 1.7 per cent decline, placing all three main indexes on observe for a fifth weekly loss in six weeks.

It was all sparked early Friday when the Bureau of Financial Evaluation reported that the Private Consumption Expenditures (PCE) index, a key gauge usually utilized by the Federal Reserve to observe inflation and deflation, remained regular at 2.5 per cent year-on-year in February. Nevertheless, the core PCE, excluding risky meals and power costs, rose to 2.8 per cent from 2.7 per cent in January, a better rise than anticipated, suggesting an inflationary scenario above the Fed’s 2 per cent goal. A separate College of Michigan research elevated the jitters, revealing a 12 per cent drop in shopper confidence in March, coupled with extra discuss of unemployment and plummeting hopes for monetary enchancment.

Tech shares tumble amid tariff fears

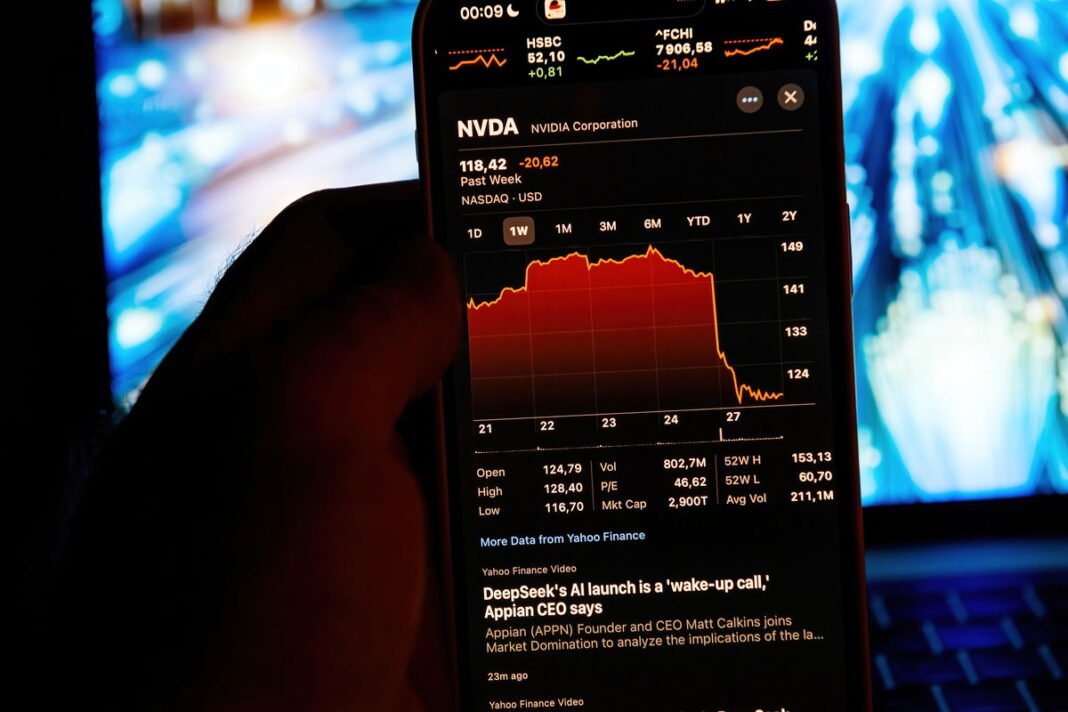

Tech shares, as soon as market darlings, noticed the largest selloffs. Nvidia, the chief in AI chipmaking, noticed shares drop practically 2 per cent regardless of simply having unveiled their next-generation AI chips. The inventory is now down 27 per cent from its January peak, dropping a jaw-dropping $1 trillion in worth.

Microsoft shares, in the meantime, got here beneath scrutiny after a report steered it was decreasing spending on its AI knowledge centre plans, though the corporate guarantees it nonetheless had stable capability to fulfill demand.

Broader doubts about AI investments coupled with dropping shopper sentiment and Trump’s tariffs seem like dragging all the pieces down. Since Trump’s November election, the S&P 500 has fallen 5.9 per cent and the Nasdaq 8.7 per cent, reflecting unease over his aggressive methods. Friday additionally noticed sharp declines in shares for Google (-4.4 per cent), Amazon, and Lululemon (-15 per cent), the latter citing a ‘cautious shopper’. As buyers dumped shares throughout tech, autos, and airways, the debut of Nvidia-backed AI enterprise CoreWeave flopped, with its IPO opening nicely under expectations, a worrying signal of failing enthusiasm for AI in these turbulent occasions.